The Value of Taking Risks

It may seem like an easy decision to invest in guaranteed return investments when rates are high, but it’s important not to lose sight of inflation. The objective with investing is to increase purchasing power through earning at a rate higher than inflation. If inflation is, say, 5% but interest rates are also 5% then the real interest rate is 0% and there is no increase in purchasing power. Increasing purchasing power can often involve taking on some level of risk. Try the tools below to learn more about the value of taking risks.

Perspective

This calculator is designed to help you take taxes and inflation into account when estimating the real value of an investment.

Potential

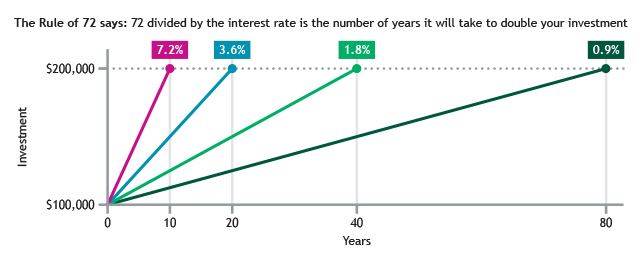

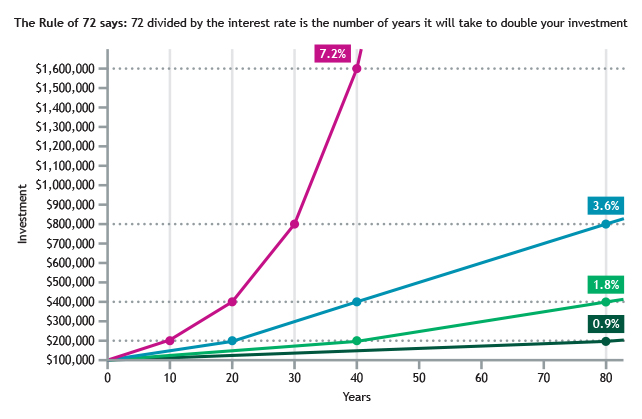

The rule of 72 is a simple approximation of how long it will take for an investment to double in value. The rule states that you can estimate the number of years it will take if you divide 72 by the annual interest rate. For example, if you have an investment with a fixed rate of 7.2% it will take approximately 10 years for the investment to double because 72 divided by 7.2 is 10, whereas, at 3.6% (half of 7.2%), it takes twice as long because 72 divided by 3.6 is 20, and so on.

The differences are staggering over the long term.

Projections

Experiment with this calculator to see how long your investment will take to double under different interest rate assumptions.

Planning

When constructing your investment portfolio, a number of factors should be considered to determine your tolerance and capacity for risk. Contact us to complete a risk questionnaire and determine which types of investments are suitable for you.